how far back does the irs go to collect back taxes

After that the debt is wiped clean from its books and the IRS writes it off. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Generally the IRS can include returns filed within the last three years in an audit.

. You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts. The IRS can go back as far as six years but generally youll only see audits for up to three years. IN GENERAL the IRS has 3 years from the date a return is filed to make an assessment and 10 years from the assessment to collect any deficiencies.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. The IRS can go back up to. However that 10 years does not begin when you neglect either accidentally or willfully to file your return.

If the IRS goes back to collect on someones unfiled tax returns before they take the opportunity to rectify the problem they could face immense fees. After that the debt is wiped clean from its books and the IRS writes it off. How do you qualify for IRS forgiveness.

How far back can the IRS go to audit my return. This is called the 10 Year. To figure out your CSED you can check the date on correspondence the IRS sent you about unpaid taxes or ask the agency for a transcript of your account.

In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes. It takes about six weeks for the IRS to process accurately completed back tax returns. An IRS Audit Can.

IRS Previous Tax Returns At the very most the IRS will go back six years in an. The IRS 10 year statute of limitations starts on the day that your. Once you file a tax return the IRS only has a decade to collect your tax liability by levying your wages and bank account or filing a.

Then you have to prove to the IRS. Then you have to prove to the IRS. In most cases the IRS goes back about three years to audit taxes.

There is an IRS statute of limitations on collecting taxes. It is true that the IRS can only collect on tax debts that are 10 years or younger. If we identify a substantial error we may add.

Remember you can file back taxes with the IRS at any time but if you want to claim. Theoretically back taxes fall off after 10 years. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes. How do you qualify for IRS forgiveness. For example if an individuals 2018 tax return was due in April 2019 the IRS acts within three years from the.

How Many Years Can The Irs Collect Back Taxes. The time period called statute of limitations within which the IRS can collect a tax debt is generally 10 years from the date the tax was officially assessed. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection.

For most cases the.

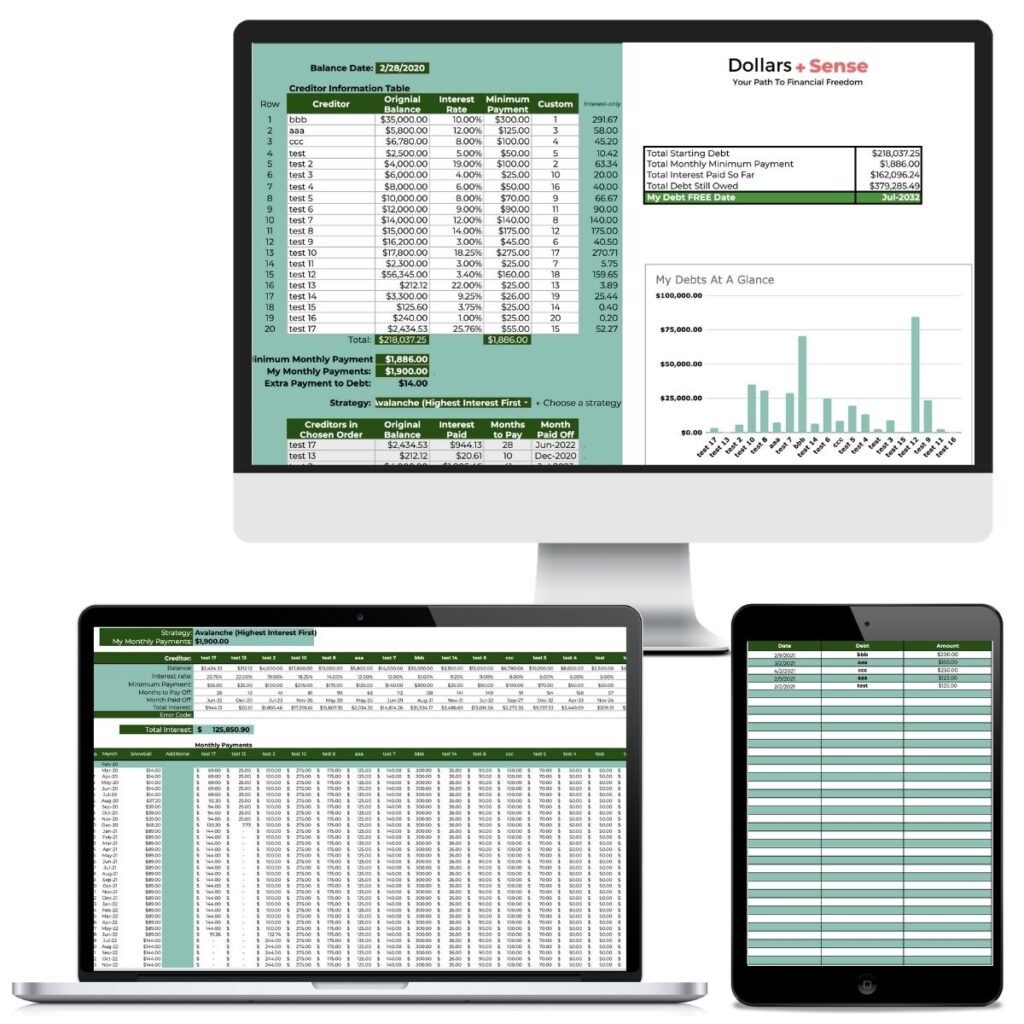

How Long Can The Irs Collect Back Taxes Dollars Plus Sense

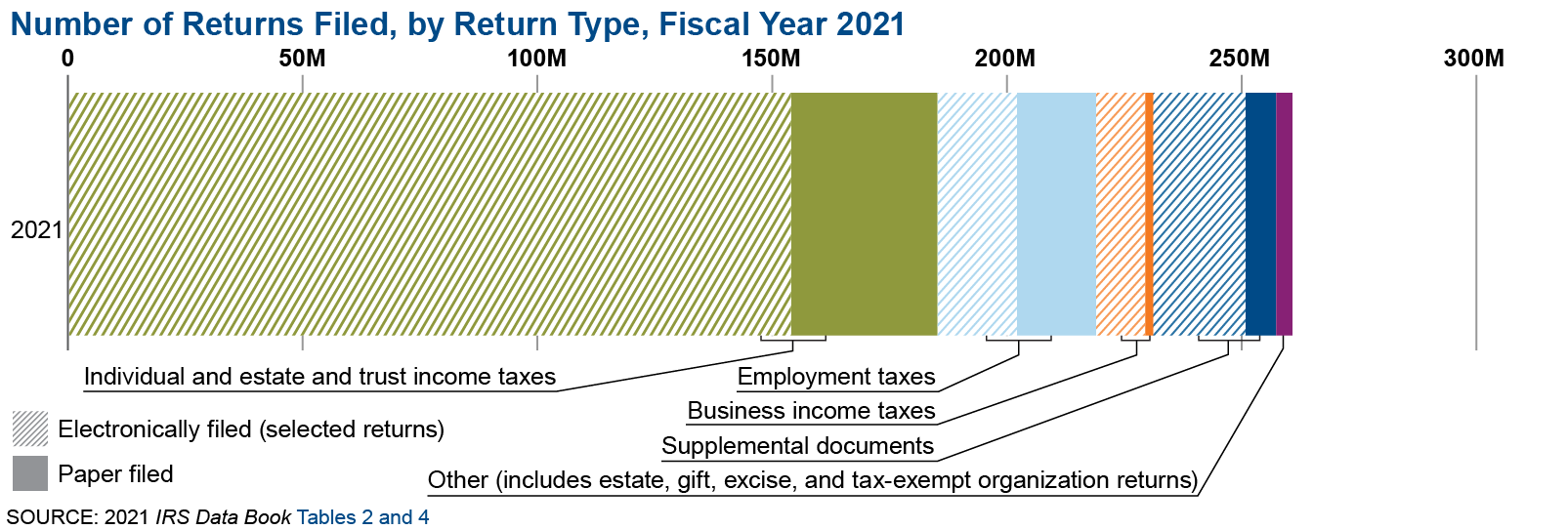

Modernizing Tax Processing Systems Internal Revenue Service

What To Do If Your Tax Refund Is Wrong

Can The Irs Take Or Hold My Refund Yes H R Block

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

How Does The Irs Collect Back Taxes Youtube

How Far Back Can The Irs Collect Unfiled Taxes

Irs Debt 5 Ways To Pay Off Landmark Tax Group

Owe Back Taxes The Irs May Grant You Uncollectible Status

Best Way To Catch Up On Unfiled Tax Returns Back Taxes

How Long Can The Irs Collect Back Taxes Dollars Plus Sense

Opinion How To Collect 1 4 Trillion In Unpaid Taxes The New York Times

Why Irs 80b Expansion Is A Nightmare For Small Business

Bringing The Irs Back To Square One Or Funding The Expanded Mission Fedmanager

How Far Has The State Gone Back For Failure To File Taxes Priortax

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

How Many Years Back Can The Irs Collect Unpaid Back Taxes Wiztax

:max_bytes(150000):strip_icc()/GettyImages-1252881116-35d3d55804a347deb0d97af3b9c6993e.jpg)

Irs Statutes Of Limitations For Tax Refunds Audits And Collections

How Long Does The Irs Have To Collect On Your Unpaid Tax Debt Youtube

Comments

Post a Comment